4 October 2022

You've worked and saved hard to build a super nest egg for your retirement. Now that you’re starting to think about the next stage of your life, it’s important to think about how you want to manage your money. You could be retired for more than 20 years, so choosing an option which could help grow your savings is something to consider.

Planning your retirement means taking stock of your super and deciding how to manage your finances. For many people super plays a key part in financing your retirement years. If you’re eligible, the Government Age Pension is also a factor when reviewing your retirement income.

There are several options to manage your retirement savings. For example, some people choose to keep their super invested in their retirement years. This means it could potentially earn investment returns over the course of their retirement.

READ MORE: AM I ELIGIBLE FOR THE GOVERNMENT AGE PENSION?

When you can access your super and the Government Age Pension

There are several ways you can access your super1. For people approaching retirement age these include:

- Reaching Preservation Age and fully retiring

- Turning 60 and ceasing employment

- Turning 65 (even if you’re still working)

You will also need to know your Qualifying Age. This is the age you can access the Government Age Pension, if you’re eligible.

4 options to consider to help manage your super in retirement

There are several options when it comes to managing your money in retirement. Below are some common choices to consider.

Option 1: Leave your money in your super account until you need it

Many people start using their super savings as soon as they retire and can access their super, but you don’t have to. If you have other income sources or savings to live on, you could leave your savings in your super account. This means your money stays invested and could continue to benefit from investment returns.

Option 2: Take your balance as a lump sum

You may choose to take your super out as a lump sum and manage it yourself. This can be done by withdrawing your super and putting it into a bank account. Once that’s done you could manage your money in several ways:

You could consider using a savings account

If you have your money in a bank account, you may consider putting some of it into a savings account. It’s important to remember interest rates on savings accounts fluctuate. The rising cost of living are something to keep in mind with this option. Consider your living costs, inflation, and the current interest rates.

It’s also worth considering that once you have withdrawn your super as a lump sum you might not be able to put it back into a super or retirement account later (for example an account based pension). This will depend on your age and the current contribution caps.

You could consider investing your money outside super

You could choose to invest your money yourself. Personal investing success can depend on the market conditions and your risk appetite. Investing successfully requires a high level of knowledge and expertise – and often time. It’s worth considering that you won’t benefit from the concessional tax rates on earnings that come with investing in super too.

Managing your own investments can give some people a new focus once they finish up at work. But for others, it can add pressure and get in the way of enjoying their retirement. Consider speaking to a financial adviser to help you decide if this is right for you.

You could consider setting up an SMSF (self-managed super fund)

Established by an individual, couple or family, SMSFs are a means of looking after your super savings. You can choose your investments and make provisions to draw an income from your SMSF after you retire – similarly to having an account based pension with your super fund.

Managing your superannuation, and even that of your family members, can be an appealing idea for some people. But it involves a lot of work, expertise and tax administration, and can come with some risk.

READ MORE: SELF-MANAGED SUPER FUNDS: WHAT YOU NEED TO CONSIDER

3. Start a Transition to Retirement strategy

Making a transition to retirement – rather than completely stopping work – gives you the flexibility to get ready for retirement based on your needs.

An AustralianSuper Transition to Retirement (TTR) Income account helps if you want to work fewer hours by balancing out your reduced salary with payments from your super. Or you can use a TTR account to reduce the amount of tax you pay on additional contributions to your super2.

READ MORE: TRANSITION TO RETIREMENT IN YOUR WAY

4. Open an account based pension

An account based pension keeps you in control of your super balance in retirement by allowing you to take your super as a regular income payment – just like when you were working.

An account based pension keeps you in control of your super balance in retirement by allowing you to take your super as a regular income payment – just like when you were working.

This option keeps your money invested by your super fund. If you have a Choice Income account based pension with AustralianSuper, the AustralianSuper investment teams invests your super, with the aim of delivering your strong, long-term returns.

Even in retirement a long-term focus is important as you may be retired for over 20 years. In most cases, making successful investment decisions requires financial expertise and a strong knowledge of how to manage risk.

The benefits of Choice Income

- Flexible payments. Choose how much you want paid straight into your bank account and how often. You can also take out extra money from your Choice Income account anytime.

- Control how you invest your balance or leave investment decisions to our experts, and you could earn returns throughout your retirement.

- Save tax. Once you turn 60, you no longer pay tax on your income payments or investment returns, even if you return to work after retirement.

By staying invested, you could help your super balance last longer – and stay in control of your money.

The difference an account based pension could make

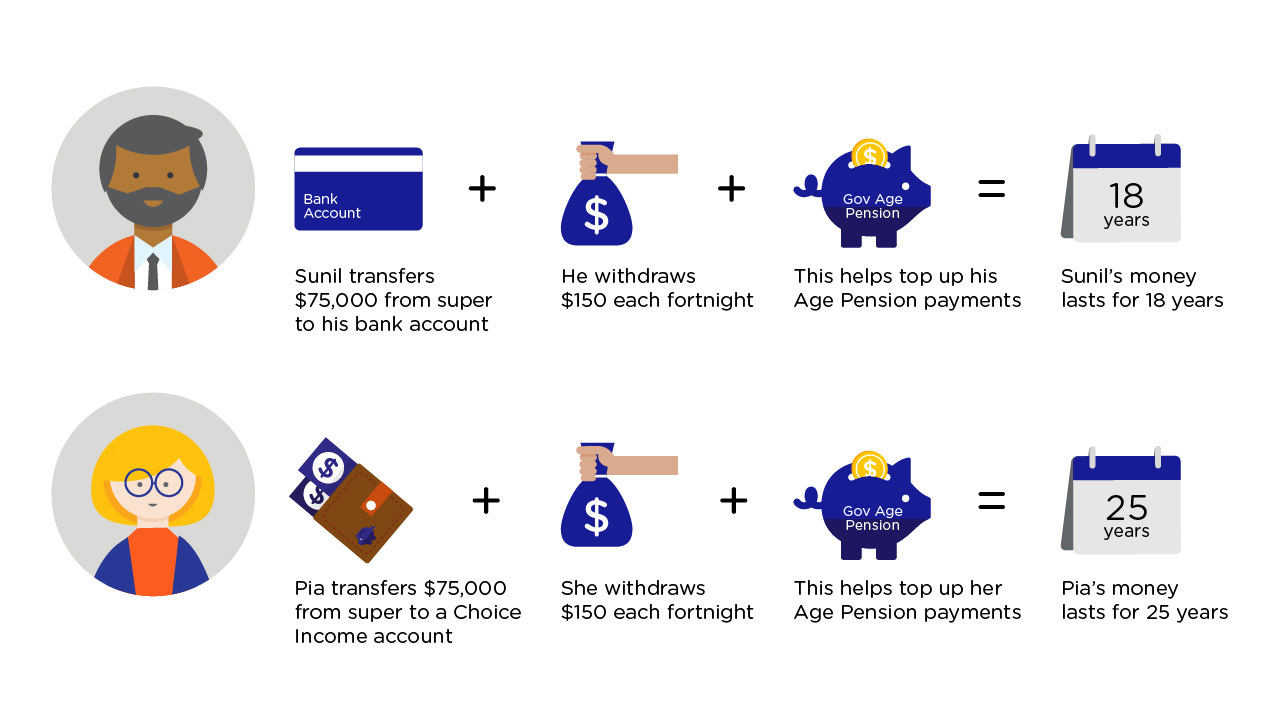

Let’s look at the example of Sunil and Pia, both aged 65 and both have a super balance of $75,000 when they retire.

- Sunil works as an IT services manager, and when he retires he puts his super balance into a savings account. He budgets well and makes sure he’s careful about how much he withdraws each fortnight.

- Pia works as a nurse and opens a Choice Income account with AustralianSuper when she retires. She likes the benefit of keeping her super invested and knows she has the flexibility to withdraw extra money anytime she wants.

Now, let’s consider the difference Choice Income could make. Sunil and Pia’s fortnightly income payments and Government Age Pension payments are the same. But because Sunil’s money is put into a savings account – instead of staying invested with Choice Income – his balance runs out 7 years before Pia's.

How an account based pension can help your super can go the distance

This case study is for illustration purposes only. Fortnightly withdrawal amounts increase each year at 3.5% p.a. Assumes AustralianSuper Choice Income admin fees of $52 p.a. plus 0.10% of your account balance up to a maximum of $600 p.a and investment 6.0% p.a. returns for Choice after fees and taxes. Assumes bank account incurs no fees and investment return of 3% p.a. after taxes. All figures calculated in today’s dollars by discounting at wage inflation of 3.5%.

The above comparison highlights how important it is to decide what to do with your super when you finish working, and how it can shape your retirement.

Calculate how long your super could last

How long your super savings will last largely depends on your lifestyle. We all live a little differently and have different retirement dreams. Whatever you are planning, it can be good to get an idea of how long your savings will last.

AustralianSuper’s Super Projection Calculator can give some insight. You can work out if you’ll have enough income from your retirement needs and estimate how long your super could last.

Manage your money your way

Whatever your plans for retirement, it’s good to know there are options. Choosing what works for you is important.

Consider speaking to an accredited financial adviser for guidance3.

5 things to consider when choosing a financial adviser

1. To withdraw your super, you must meet a condition of release under super law.

2. Transition to Retirement (TTR) can be complex and isn’t suited to everyone. It’s a good idea to get financial advice before deciding if a TTR Income account is right for you.

3. Personal financial product advice is provided under the Australian Financial Services Licence held by a third party and not by AustralianSuper Pty Ltd. Fees may apply.

Investment returns aren’t guaranteed. Past performance is not a reliable indicator of future returns.

This information may be general financial advice which doesn’t take into account your personal objectives, situation or needs. Before making a decision about AustralianSuper, you should think about your financial requirements and refer to the relevant Product Disclosure Statement. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the TMDs at australiansuper.com/TMD.

AustralianSuper Pty Ltd ABN 94 006 457 987, AFSL 233788, Trustee of AustralianSuper ABN 65 714 394 898.