How to know AustralianSuper is the right choice for you

Significant net benefit

This is what your overall financial position could be after taking away admin and investment fees. Take a look at the chart below to see how AustralianSuper’s net benefit has outperformed the average super fund and retail fund over 5, 10, and 15 years.

Investing globally for members

As Australia’s largest, most-trusted2 super fund we use our size and investment expertise, together with our global reach to find the best investment opportunities and help lower investment costs.

Compare net benefit performance

- Super

- Account based pension

How your super fund performs over the long-term will make a big difference to your money for retirement. We focus on what that performance means for the net benefit of your super. See why choosing a top performing fund could help you grow your money for the retirement you want. The table below shows how the net benefit of AustralianSuper’s Balanced option compares to others.

| Net Benefit – Super | |||

|---|---|---|---|

| Over 5 years | Over 10 years | Over 15 years | |

| AustralianSuper Balanced option | $20,772 | $83,835 | $126,778 |

| All super funds (average) | $15,999 | $66,995 | $103,731 |

| Retail super funds (average) | $13,646 | $56,333 | $79,183 |

Net benefit refers to investment earnings to 31 December 2022 (less administration and investment fees and costs). Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

The table shows what a member would have for 5, 10 and 15 years to 31 December 2022, in addition to a $50,000 starting balance and employer contributions, assuming they started with a $50,000 annual salary4.

-

Important information

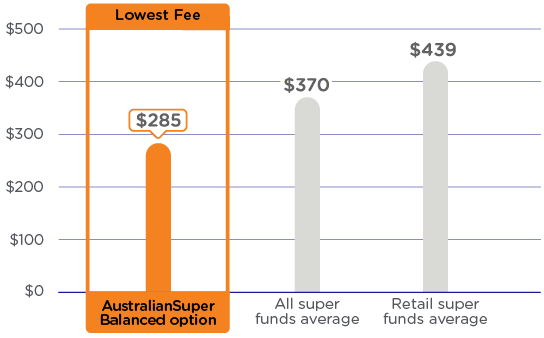

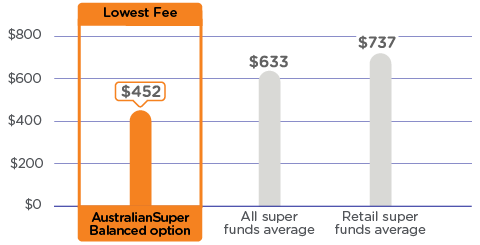

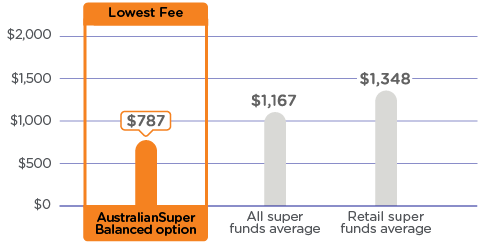

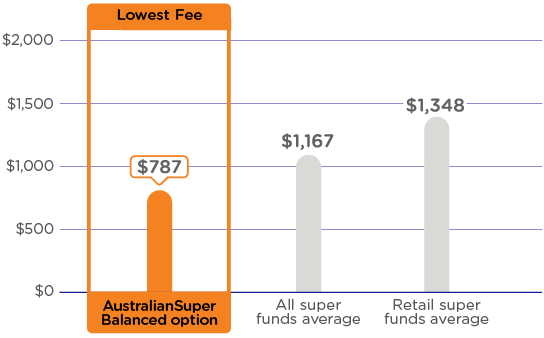

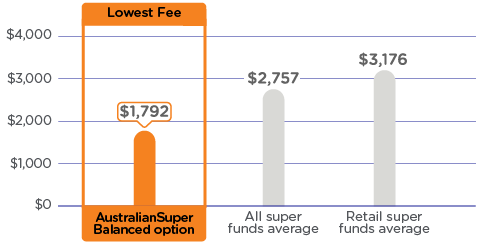

Source: SuperRatings Pty Ltd. Comparison of administration and investment fees at 30 June 2021 for the AustralianSuper Balanced option, the all industry average fund and the average Retail Master Trust. The sample includes the largest balanced option for 376 funds within the SuperRatings' Balanced (60 - 76 growth allocation) universe, for accumulation type products. The All Industry average is inclusive of Retail (Master Trust), Industry, Corporate and Government type funds.

The AustralianSuper fee is the administration fee for super (accumulation) accounts and the investment fee for the Balanced option for FY 2020/21. The Investment fee is likely to change from year to year and is different for each investment option. Insurance premiums and other fees and costs may apply. See australiansuper.com/fees for full details of all fees and costs.

Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns.

Joining us is easy

It’s easy to see the difference a top-performing fund could make. Become a member in under 15 minutes.

-

Important information to consider

- AustralianSuper Balanced investment option compared to the SuperRatings Fund Crediting Rate Survey - SR50 Balanced (60–76) Index to 31 December 2022. Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns. Returns from equivalent investment options of the ARF and STA super funds are used for periods before 1 July 2006.

- Readers Digest Most Trusted Brands – Superannuation category winner for 11 years running 2013-2023 according to research conducted by leading independent research agency Catalyst Research. Ratings are only one factor to be taken into account when choosing a super fund.

- AustralianSuper received the Canstar Outstanding Value Award – Superannuation in 2022 and Outstanding Value Award – Account Based Pension in 2022. Ratings are only one factor to be taken into account when choosing a super fund. Read the full methodology for super here and methodology for account based pension here.

- Comparisons modelled by SuperRatings, commissioned by AustralianSuper. The outcome shows the average difference in ‘net benefit’, a measure of past investment earnings after administration fees, investment fees and costs and taxes have been taken out. The results compare the AustralianSuper Balanced investment option and comparable balanced options, for historical periods to 31 December 2022. Insurance premiums and other fees and costs may also apply. Outcomes vary between individual funds. See Assumptions for more details. Investment returns are not guaranteed. Past performance is not a reliable indicator of future returns. Returns from equivalent options of the ARF and STA super funds are used in calculating return for periods that begin before 1 July 2006.

- Comparisons modelled by SuperRatings, commissioned by AustralianSuper. The outcome shows the average difference in ‘net benefit’, a measure of past investment returns after administration, investment fees and costs and transaction costs have been taken out. The results compare the AustralianSuper Choice Income Balanced investment option and comparable pension balanced options, for historical periods to 31 December 2022. The model uses return and fee data that is submitted to SuperRatings. The model assumes: a starting age of 65 commencing 1 January 2013 and finishing on 31 December 2022; a starting balance of $300,000; and a drawdown rate of 6% p.a. Insurance premiums and other fees and costs may apply. Outcomes vary between individual funds. Figures have been rounded to the nearest $100. See Assumptions for more details about modelling calculations and assumptions. Investment returns aren’t guaranteed. Past performance is not a reliable indicator of future returns.